Resources

Lending Expertise

The End of the First Inflation Wave

November 16, 2023

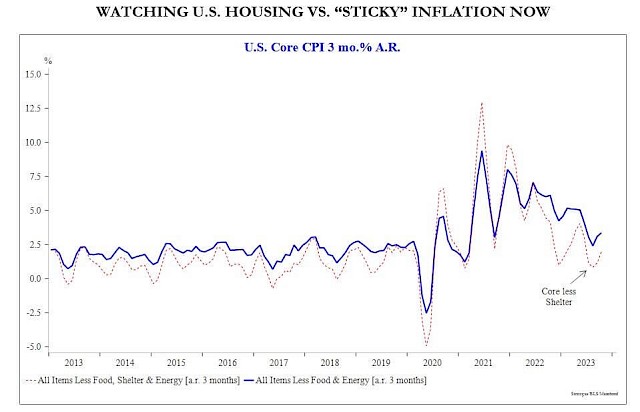

- The U.S. Producer Price Index fell -0.5% m/m in Oct, and slowed to 1.3% y/y. The pipeline data show that this first inflation wave is basically over now.

- U.S. (nominal) retail sales showed some weakness in Oct as autos & gasoline prices fell, with the headline number declining -0.1% m/m. An offset is that control group sales rose +0.2% m/m with upward revisions to the prior month.

- Bottom line: Inflation rose quickly and is falling quickly. The debate remains how much economic pain (eg, rising unemployment) accompanies a continued slowdown in inflation, and whether inflation stays down in future years if the labor market remains tight & the U.S. consumer keeps spending.

Source: Brian S. Wesbury, Chief Economist, Robert Stein, Deputy Chief Economist, First Trust

Financial Term Definitions

The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

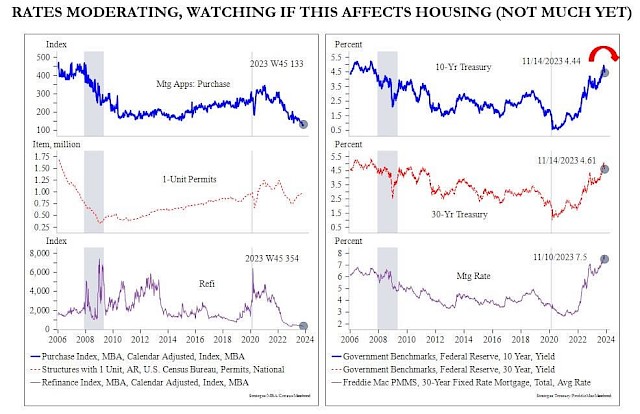

Mortgage Rates: Daily Rate Index

November 3rd's jobs report brought an outstanding week for Treasuries and mortgage rates to an outstanding conclusion. From there, the following week (last week) was sorely lacking in inspiration. Markets were anxiously awaiting yesterday's release of the Consumer Price Index (CPI) and it did not disappoint.

Loan Program Spotlight

Lower Payments with an ARM

Hidden Keys to a Smaller Mortgage Payment

Did you know that seller concessions can mean a smaller mortgage payment for your buyers? They can use them toward a temporary rate buydown to lower their interest rate at the beginning of their loan, which could offer significant savings.

With a 2-1 temporary buydown, your buyer's interest rate would be reduced by 2% the first year of their loan and 1% for the second. The best part? The buydown is covered by the seller — that means more money in your buyer's pocket for savings, repairs and more.

Latest News

Cost of Living, Mortgage Rates Keeping Many Homebuyers 'on the Sidelines'

For the second consecutive week, Freddie Mac's Primary Mortgage Market Survey (PMMS) has shown a dec...

Read More

Read More

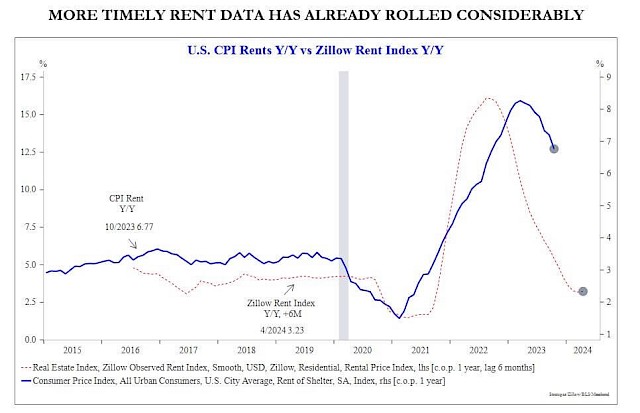

Property taxes have been rising. Here's what it means for housing

In many communities, homeowners and homebuyers have been hit with eye-popping property tax increases. How much impact higher taxes are having on local housing and mortgage markets?

Read More

Read More

We do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act. This letter is for informational purposes only and is not an advertisement to commit to lend or extend customer credit as defined by section 12 CFR 1026.2 Regulation Z. Restrictions and conditions may apply. Terms, rates, data, programs, information, and conditions are subject to change without notice, and may not be available in all areas. Fortem Loans, LLC is licensed by the Department of Financial Protection and Innovation under the California Financial Lenders Law License, NMLS# 2315626 , DFPI# 60DBO-165158. Subject to Borrower Approval.

![Mortgage Rates Daily Index [11.15.2023] Mortgage Rates Daily Index [11.15.2023]](/site/assets/files/1391/mortgage_rates_daily_index_11_15_2023.jpg)